Trade Department

This section contains measures pertaining to the trade division that also support international trade operations.

This section contains measures pertaining to the trade division that also support international trade operations.

|

|

|

|

|

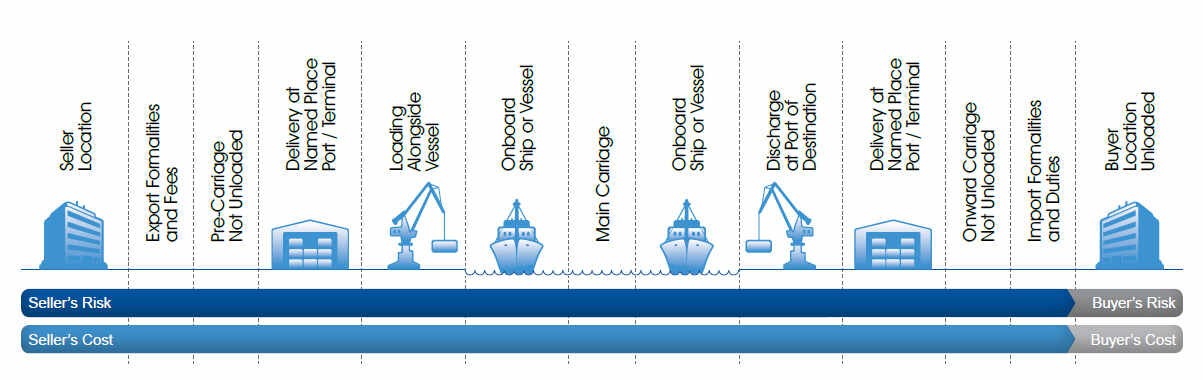

Under the Delivered Duty Paid (DDP) Incoterm rules, the seller assumes all responsibilities and costs for delivering the goods to the named place of destination. The seller must pay both export and import formalities, fees, duties and taxes. The seller is not obligated to insure the goods for pre-carriage or main carriage. The buyer is free of any risk or cost until the goods are unloaded from the vehicle at the named place of destination, usually the buyer’s place of business. DDP is the only Incoterms rule that places responsibility for import clearance and payment of taxes and/or import duty on the seller. These last requirements can be problematic for the seller. In countries with complex or bureaucratic import clearance procedures a seller with local knowledge may prefer to take on these responsibilities.